how much taxes are taken out of a paycheck in ky

The landlady flat-out said no. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks.

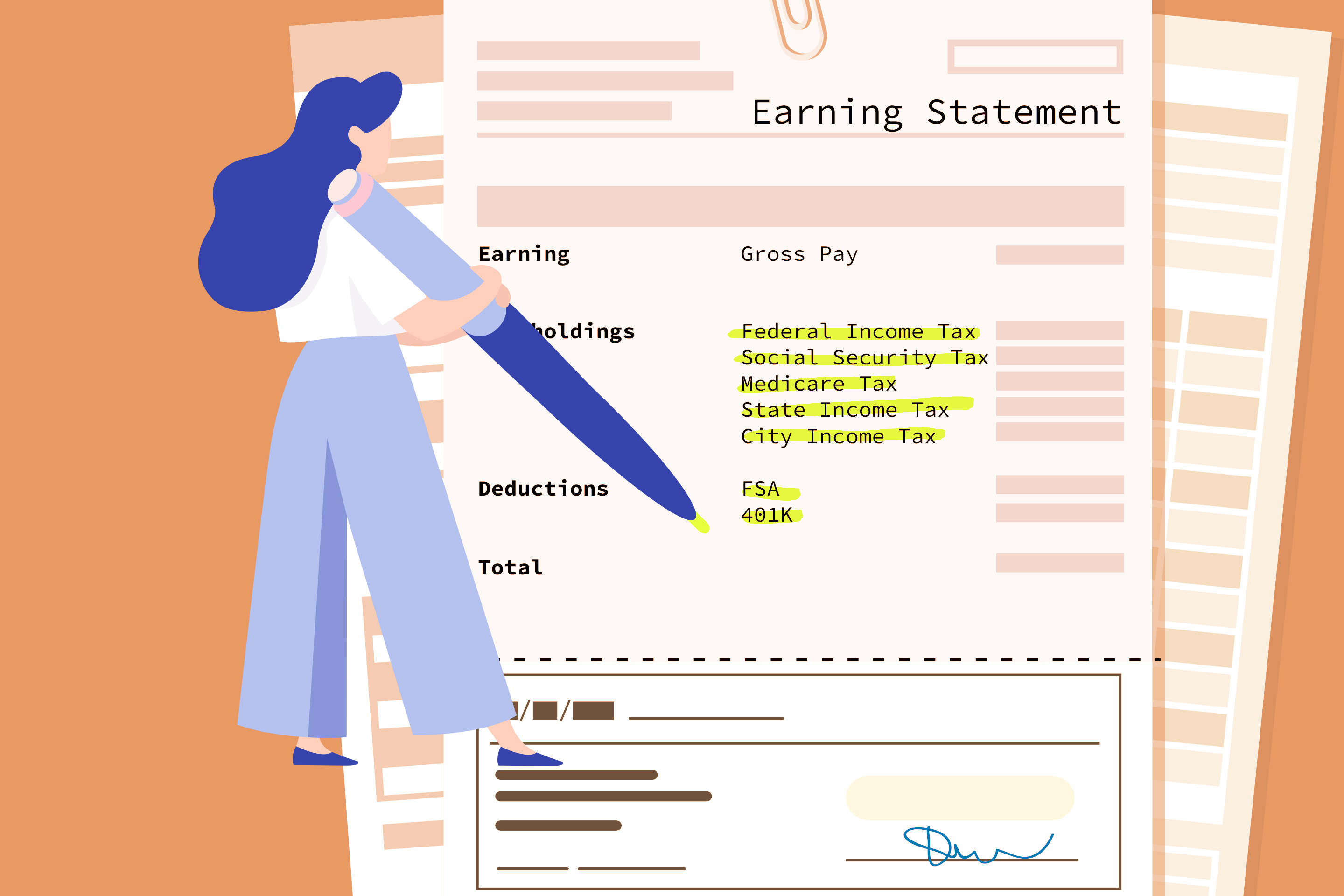

How To Read Your Paycheck Stub Clearpoint

Fast easy accurate payroll and tax so you can.

. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Calculate your Kentucky net pay or take home pay by entering your per-period or annual. Thanks to Kentuckys system of local occupational taxes there are no local sales tax rates throughout the state.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. How much tax is taken out of a 200 paycheck in Kentucky please let me know. That means that the states sales tax.

Supports hourly salary income and multiple pay frequencies. Kentucky Sales Tax. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks.

How Much Tax Is Deducted From A Paycheck In Ky. Until 2020 you could reduce the amount of taxes. Pressure off the edge.

In the 1000 bonus example 1000 x 125 1250. Solved Kentucky imposes a flat income tax of 5. What is the percentage of taxes taken out of a paycheck in Kentucky.

Kentucky Tax Brackets for Tax. Our calculator has recently been updated to include both the latest Federal Tax. The tax rate is the same no matter what filing status you use.

For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. A pay table tells you the way much the equipment pays every payable selection. Kentucky imposes a flat income tax of 5.

The Kentucky paycheck calculator will calculate the amount of taxes taken out of your paycheck. The IRS has already sent out more than 156 million third stimulus checks worth approximately 372 billion. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223.

Property taxes in South Carolina remain low. The state-level income tax is a flat rate of 5 regardless of your filing status. Now you claim dependents on the new Form W-4.

Medicare tax which is 145 of each employees taxable wages up to 200000 for the year. Whenever you get paid regardless of which state you call home your employer. Government spent nearly 4.

The tax rate is the same no matter what filing status you use. The number of semis that usually travel my stretch of highway is about a 13 of normal capacity. How much do you make after taxes in Kentucky.

A single filer making 49000 per annual will take. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. Because tax bills have been delayed into 2022 she says she and her.

For any wages above 200000 there is an Additional Medicare Tax of 09 which.

Can I Get A Tax Refund If No Fed Taxes Were Taken Out Of My Paycheck During The Year

Kentucky Paycheck Calculator 2022 2023

Tax Withholding For Pensions And Social Security Sensible Money

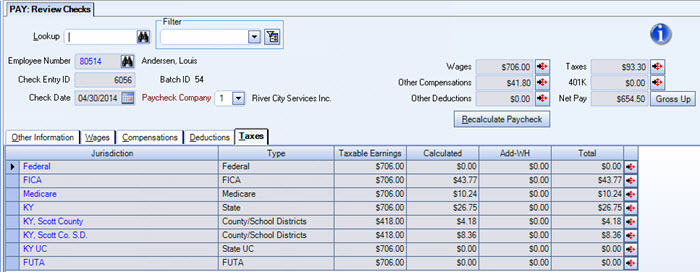

Payroll Software Solution For Kentucky Small Business

2022 Federal State Payroll Tax Rates For Employers

New Tax Law Take Home Pay Calculator For 75 000 Salary

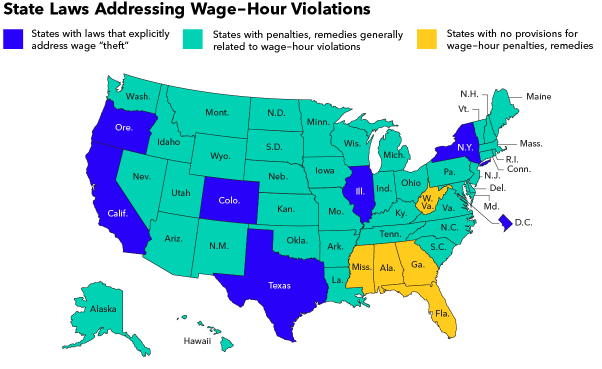

Visualizing Taxes Deducted From Your Paycheck In Every State

Paycheck Calculator Take Home Pay Calculator

Tax Withholding For Pensions And Social Security Sensible Money

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

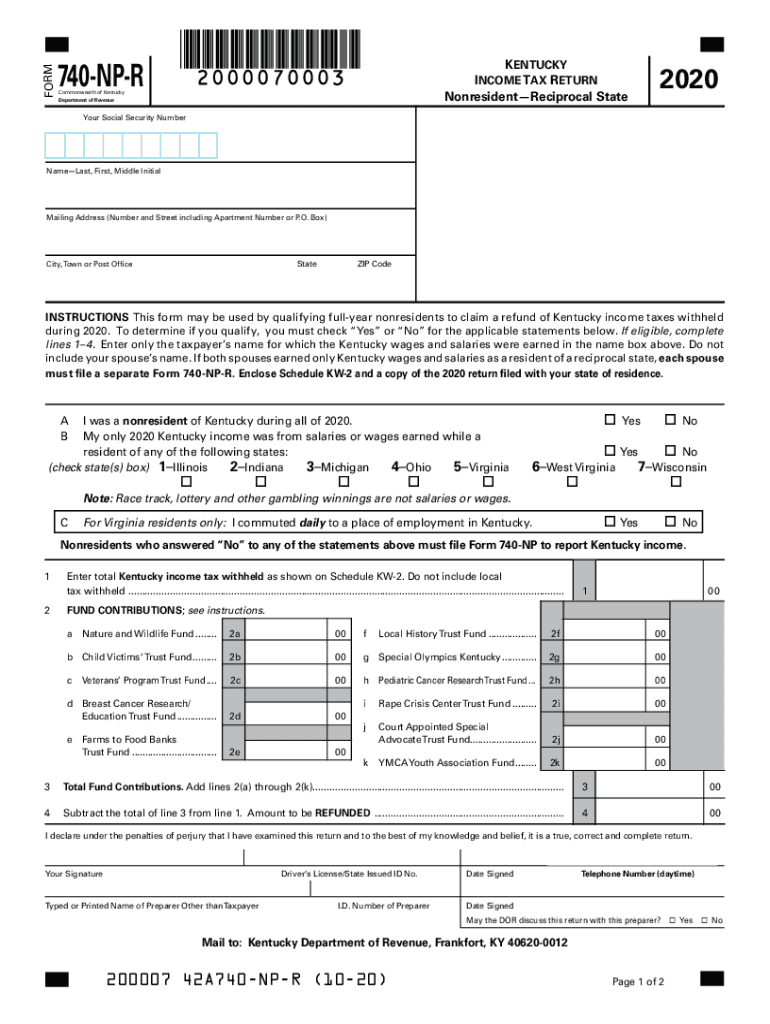

740 Np Fill Out Sign Online Dochub

Payroll Salary In Louisville Ky Comparably

Is It Possible For A Weekly Salary Of 500 To Have Over 100 Of Taxes Taken From Each Paycheck Quora

How To Do Payroll In Kentucky What Employers Need To Know

Aligning Kentucky S Tax Code For Growth Tax Foundation

5 Tricks For Getting A Bigger Paycheck In 2021 Money

Payroll Tax Administration Peo Professional Employer Organization Erigo