does texas require an inheritance tax waiver

You will not owe any estate taxes to the state of Texas regardless of the amount of your estate. The estate tax is different from the inheritance tax which is taken by the government after money or possessions have been passed on to the deceased persons heirs.

Death And Taxes Nebraska S Inheritance Tax

An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations.

. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. If you need additional information call us toll free. Noncompliance with electronic reporting or payment penalty waivers.

Estate tax of 08 percent to 16 percent on estates above 5 million. Ohio does not require a waiver if the transfer is to a surviving spouse and the. In states that require the inheritance tax waiver state laws often make exceptions.

The state has set a 525 million estate tax exemption meaning if the decedents estate. Because the state is free of inheritance tax heirs to an inheritance wont be taxed on it. When do you need an estate tax waiver in Indiana.

There is a 40 percent federal tax however on estates over 534 million in. However other states inheritance taxes may apply to you if a loved one who lives in those states. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due.

As of 2019 only twelve states collect an inheritance tax. The federal government of the United States does have an estate tax. Right now there are 6 states that have an inheritance tax.

The federal estate tax. Ad Better than all forms and kits. While New York doesnt charge an inheritance tax it does include an estate tax in its laws.

Inheritance tax waiver is not an issue in most states. On the one hand Texas does not have an inheritance tax. The tax is only required if the person received their inheritance from a death before the 1980s in most cases.

What is the inheritance tax rate in Massachusetts. Inheritance tax of up to 10 percent. When someone dies their estate goes through a legal process known as probate.

Its usually issued by a state tax. However you may owe money to the federal government. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up.

Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015. Texas Inheritance Tax and Gift Tax. New york state does not require waivers for estates of anyone.

Arizona does not have these kinds of taxes which some states levy on people who either. Ohio does not require a waiver if the transfer is to a surviving spouse and the value of the estate is less than 25000. Federal legislation passed in 2001 authorizes the elimination of the federal estate and gift tax by 2009.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. For example Indiana requires a waiver if the deceased person was a resident of the state unless the estate is being. The state of Texas is not one of these states.

The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released. What is an inheritance tax waiver. Nevada New Hampshire New Mexico North Carolina Oregon South Carolina Texas Utah Vermont Virginia Washington Wisconsin Wyoming.

Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. Jan 07 2022 Final individual federal and state income tax returns. No inheritance tax is due on inheritances to a surviving spouse child or grandchild.

Alabamas filing requirement is based on the federal estate tax credit allowed under the federal estate tax law. The following states do not require an Inheritance Tax Waiver. Kentucky Inheritance and Estate Tax Forms and Inheritance and Estate from documentspub.

An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. How long does it take to get an inheritance. Since Florida is on the above list the state does not require an Inheritance Tax Waiver.

Inheritance tax is a tax imposed on those who inherit assets. Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania. There is also no inheritance tax in Texas.

Late returnpayment penalty waivers. As a result of the federal tax changes enacted in 2001 estates where the decedents date of death is after December 31. In Connecticut for example the inheritance tax waiver is not required if the successor is a.

Arizona residents do not need to worry about a state estate or inheritance tax.

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

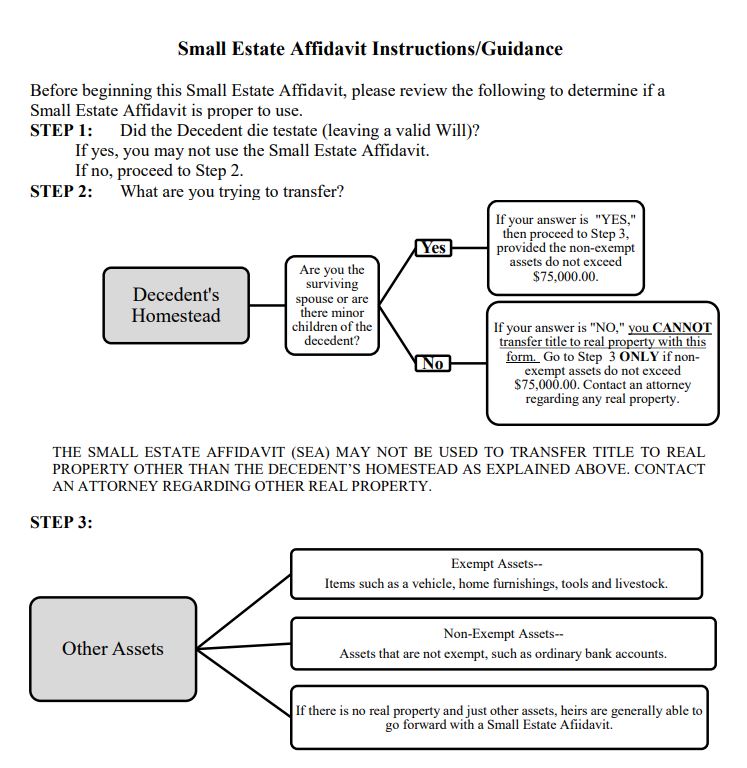

When Is It Proper To Use A Small Estate Affidavit In Texas

Texas Estate Planning Around 2022 Tax Exemptions Houston Estate Planning And Elder Law Attorney Blog November 23 2021

How Do State Estate And Inheritance Taxes Work Tax Policy Center

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Pennsylvania Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Texas Have An Inheritance Tax Rania Combs Law Pllc

Texas Attorney General Opinion Ww 277 The Portal To Texas History

Does Every Estate Have To Pay An Estate Tax Rania Combs Law Pllc

Utah Estate Tax Everything You Need To Know Smartasset

Michael Cohen Dallas Elder Lawyer Assets Attorney Benefits Care Deeds Elder Estate Firm Lady Bird Law Lawyer Living Medicaid Planning Poa Power Of Attorney Probate Protect Protection Social Security Trusts Va

Waiver Of Service Guide Texas Divorce Laws

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service